Financial Aid Process

Students attending Martinsburg College may qualify for need-based grants.

Types of Federal Student Aid Available

Federal Grant Programs

Pell Grant

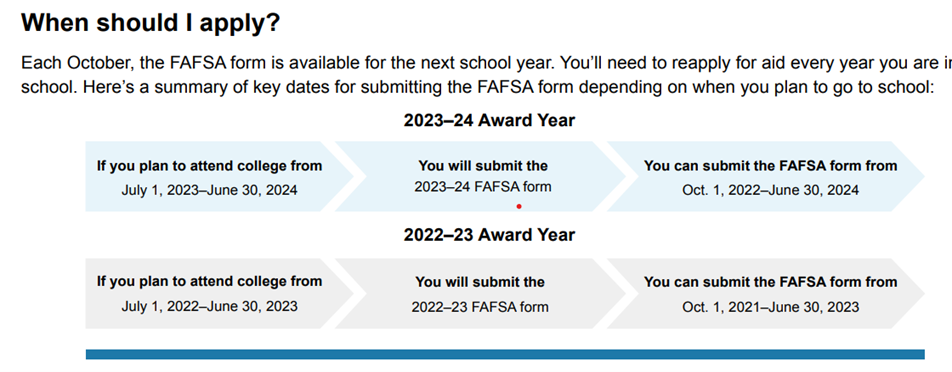

A Federal Pell Grant, unlike a loan, does not have to be repaid. Pell grants are awarded to students who demonstrate financial need and who have not yet earned a bachelors or professional degree. The maximum award for the 2023-2024 award year (July 1, 2023 to June 30, 2024) is $7395. The maximum award may change each award year and depends on program funding.

The Pell Grant amount awarded will depend on:

- Estimated Family Contribution (EFC)

- Cost of Attendance

Federal Student Aid Eligibility

The following criteria must be met for a student to be eligible to participate in Federal Student Aid (FSA):

- Be an admitted student enrolled in an eligible program of study

- Not be currently enrolled in secondary school.

- Be a high school graduate or recognized equivalent

- Be a U.S. citizen or national, or an eligible non-citizen (verification of eligible non-citizen status may be required.)

- Have a valid Social Security number.

- Not have been convicted of an illegal drug-related offense. If convicted, the student must visit FAFSA online, click “Before Beginning a FAFSA” and complete the “Drug Worksheet” (on the left) to determine if it will affect eligibility. Additional help is available by calling 800-4FED-AID / 800-433-3243

- Not be incarcerated.

- Not be in default on a Federal Student Loan or owe an overpayment on a FSA grant or loan.

- If the student is a male, he must be registered with the Selective Service.

- Maintain Satisfactory Academic Progress (SAP) once approved for funding.

- Certify that FSA will only be used for educational purposes.

- Demonstrate financial need.

Applying for Financial Aid

Step 1

The first step is to apply for your Federal Student Aid ID and password. Students will need to have a Federal Student Aid ID and password to sign the FAFSA form and other electronic financial aid forms. Submit your online application at https://studentaid.gov/fsa-id/sign-in/landing. If you do not have a FSA ID, please select, ‘Create Account’ to get started.

Step 2

The Free Application for Federal Student Aid (FAFSA) is the next step. You may access the FAFSA online at this website address: https://studentaid.gov/h/apply-for-aid/fafsa

If you prefer a hard copy of the form, please contact the Financial Aid Office.

Have the following information available to complete your application.

Social Security Number

Alien Registration Number

Prior-Prior Year Tax Return/W’2

Driver’s License Savings, investment, and asset information

Untaxed income information

Step 3

The Department of Education may select your application to verify the information reported on your FAFSA. You may also be required to submit other documents such as proof of citizenship. The office of financial aid will notify you if these documents are needed.

Financial Aid Forms can be submitted electronically by email to:

or faxed to: 1-866-519-0983

or mailed to:

Martinsburg College

341 Aikens Center

Martinsburg, WV 25404

Attn: Financial Aid Office

Disbursement of Federal Student Aid

To be eligible for a disbursement of aid, you must meet all disbursement requirements. Some of the general disbursement requirements include:

- Submission of all required documents

- Meeting all satisfactory academic progress requirements

- After fees have been settled, any difference is refunded to the student via ACH Direct Deposit or in a check mailed to the student. ACH Direct Deposits and the mailing of checks to students are handled by the accounting office.

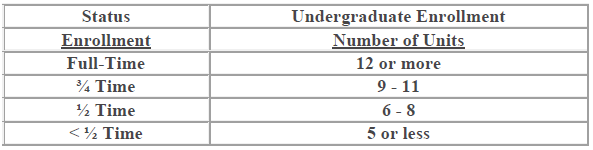

Financial Aid & Enrollment Status

All students are considered full-time in each payment period. Please keep in mind that most financial aid funds are disbursed in two payments for the academic year.

Pell Grant

Disbursements of Pell grants will be prorated (adjusted) based on the number of hours in each payment period.

Requirements to Maintain Eligibility for Federal Financial Aid

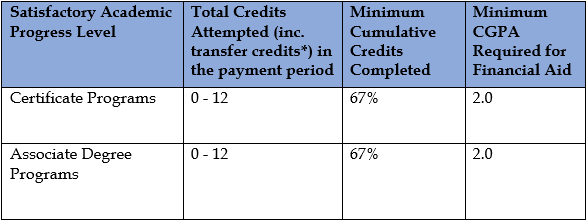

Students utilizing federal student aid funding must meet satisfactory academic progress (SAP) standards in order to maintain eligibility for the funding. Please see below for information regarding the SAP requirements.

Satisfactory Academic Progress Policy

To be eligible for FSA funds, a student must make satisfactory academic progress. Martinsburg College’s Satisfactory Academic Progress (SAP) policy measures progress on a qualitative and quantitative basis. The institution will evaluate a Title IV financial aid recipient’s SAP at the end of each payment period. Any student who is failing to achieve SAP standards will be notified in writing. The chart below provides the minimum quantitative and qualitative requirements:

*Credits transferred in from another institution are included in the above calculation but transfer credits do not affect the student’s GPA calculation.

A grade of Incomplete (I) is not included in the GPA but is considered towards a student’s non-completion of attempted coursework until the grade is replaced with a permanent grade and the progress can be re-evaluated. It is the responsibility of the student to submit the required coursework within forty-five (45) days of being issued a grade of Incomplete. Failure to meet this requirement will result in the Incomplete grade being changed to a grade of F.

A course withdrawal (W) is not included in the GPA but is considered towards a student’s non-completion of attempted course work.

A failing (F) grade is treated as attempted credits that were not earned and are included in both the qualitative and quantitative calculations.

Maximum Timeframe for Completion

All students who receive federal financial aid are required to complete their programs of study within 150% of the published length of the program. The following maximum timeframes apply to each program offered by Martinsburg College:

Certificate programs

| Published length in Credits | Maximum Period must not exceed: |

|---|---|

| 18 | 27 |

| 21 | 31.5 |

| 24 | 36 |

| 30 | 45 |

| 36 | 54 |

| 42 | 63 |

Associate degrees – the published length is 60 credits. The maximum period must not exceed 90 total semester credits attempted.

Course Repeat Policy

Students receiving Title IV federal financial aid may repeat a course. Credits from both course attempts will be counted in total semester credits attempted and in minimum cumulative credits completed at Martinsburg College, but only the highest grade received will be included in the calculation of minimum cumulative GPA. Credits from both course attempts will also count toward the maximum timeframe for completion.

All periods of a student’s enrollment count when assessing progress, even periods in which a student did not receive FSA funds.

Academic Progress Warning and Probation

The first occurrence of a student not meeting SAP requirements will result in the student being placed on an academic progress warning. This warning will be emailed to the student. The student will have one additional evaluation period to correct the deficiency and meet the minimum requirements at the next evaluation point. Students placed on Academic Progress Warning will be required to have a counseling session with an instructor and/or student advisor to develop a plan in order for the student to improve his/her performance. The warning period lasts for one payment period only during which time students may continue to receive FSA funds. Students who fail to make satisfactory progress after the warning period will lose their aid eligibility unless they successfully appeal and are placed on probation. Appeals may be submitted on the basis of injury or illness, the death of a relative, or other special circumstances. The student’s appeal must explain why s/he failed to make satisfactory progress and what has changed in his/her situation that will allow him/her to make satisfactory academic progress at the next evaluation. The appeal will be submitted to the Appeals Committee who will make a determination within 10 days.

If the Appeals Committee determines that the student should be able to meet the SAP standards by the end of the subsequent payment period, the student may be placed on academic probation for one additional payment period. The probation period lasts for one payment period only. If at the end of this time, the student is not making SAP, the student will be dismissed from the program.

Reinstatement

Students who are disqualified and/or denied Financial Aid from a prior probation period, who at the recommendation of the Financial Aid Office attended the institution without financial aid for one academic year (completing at least 12 credits total per semester) may be eligible for reinstatement and regain eligibility for financial aid. Upon completing such units, students are required to submit a Satisfactory Academic Progress Appeal to the Financial Aid Office and provide in-depth details as to when the student completed the reinstatement requirements. All students who have been academically disqualified are ineligible for Financial Aid and can only regain financial aid eligibility through the appeal process. Students who are reinstated are also required to participate in a Satisfactory Academic Progress Counseling Session with the Director of Student Services as part of the SAP Policy.

Contact Information

We realize that the financial aid process can seem daunting but we are committed to helping you through this process. Please do not hesitate to contact us should you have any questions or concerns. For information regarding federal student aid programs please contact:

Debra Haytas, Director of Financial Aid

Email: [email protected]

Martinsburg College

341 Aikens Center

Martinsburg, WV 25404 Telephone: (304) 945-0654

Javier Flores, Financial Aid Administrator

Email: [email protected]

Martinsburg College

341 Aikens Center

Martinsburg, WV 25404 Telephone: (304) 278-3421

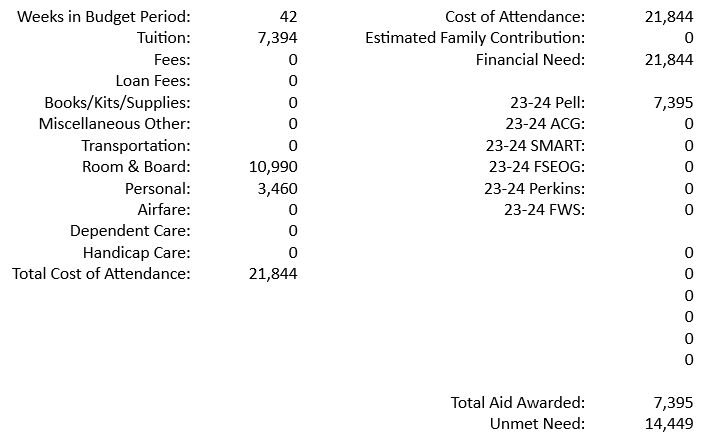

Cost of Attendance Information

Cost of Attendance

Find Out Your Cost of Attendance before you Start School

Know up front what your estimated costs are for attendance at Martinsburg College. The Needs Analysis – or Cost of Attendance – below gives you a picture of what you need to budget to attend the college. This calculation is used to determine your “financial need,” which is the basis of financial aid award packages, as well as eligibility for other types of financial assistance.

The tuition rate will vary depending upon the program, the number of credits taken per year and the number of transfer credits awarded. For all certificate programs, the cost per credit varies from $250 – $308.11. For associate degree programs, the cost per credit is $308.12.

Direct and Indirect Costs

Both direct and indirect costs make up the cost of attendance.

- Direct costs are usually paid directly to the institution. These include: tuition and any fees.

- Indirect costs are additional expenses you may incur while attending school, which are not paid to the college. Personal expenses, room and board are examples of indirect costs.

Even though Martinsburg College is a fully distance learning institution, we are permitted by federal regulations to include reasonable cost for living expenses (room and board). However, the room cost is excluded for students who live in military housing or receive a military housing stipend.

The following budget items are included as part of the Cost of Attendance:

- Tuition

- Materials, supplies and miscellaneous fees

- Room and board

- Dependent care (if applicable)

2023-2024 Cost of Attendance:

Please Note: The estimates above apply to full-time, first-time degree/certificate-seeking undergraduate students only.

These estimates do not represent a final determination, or actual award, of financial assistance or a final net price; they are only estimates based on cost of attendance and financial aid provided to students for the current award year. Cost of attendance and financial aid availability change year to year. These estimates shall not be binding on the Secretary of Education, the institution of higher education, or the State.

Students must complete the Free Application for Federal Student Aid (FAFSA) in order to determine their eligibility for Federal financial aid that includes Federal grant, loan, or work-study assistance. For more information on applying for Federal student aid, go to https://studentaid.gov/h/apply-for-aid/fafsa.

Note: Room and board is an allowance not an actual charge.

The personal expense category is an allowance and not a charge.

Each of these allowances is listed to assist students to cover expenses necessary for school attendance. However, students do not have to use federal funds to cover these expenses.

For more information regarding federal student aid programs available at Martinsburg College, please contact the Financial Aid Office:

Debra Haytas

(304) 945-0654

[email protected]

Financial Aid Director

Martinsburg College

341 Aikens Center

Martinsburg, WV 25404

Javier Flores

(304) 278-3421

[email protected]

Financial Aid Administrator

Martinsburg College

341 Aikens Center

Martinsburg, WV 25404